Debt, Dreams, and Digital Help: Why India’s Middle Class Is Struggling with EMIs and How Financial Literacy and AI Can Help

EMIs: The Middle-Class Dilemma

Imagine this: You’re a 35-year-old professional living in Pune. You have a stable job, a modest car, a decent apartment, and dreams for your kids to attend a top university. But each month, half your salary vanishes into EMIs—a car loan, a home loan, a personal loan taken during the pandemic, and credit card dues. There’s very little left for savings, and even less for enjoyment.

Sound familiar? You’re not alone. India’s middle class, once a symbol of steady growth and upward mobility, is increasingly feeling the pinch. Rising costs, easy credit, and a culture of aspirational consumption have turned many into reluctant debtors. But here’s the silver lining: with better financial literacy and the help of AI, this cycle can be broken.

This blog will explore why the Indian middle class is under financial stress, how debt and EMIs are eating into savings, and how digital tools and smarter choices can help people regain control of their finances.

The Rise (and Strain) of India’s Middle Class

India’s middle class is growing in size and ambition. According to the People Research on India’s Consumer Economy (PRICE), over 300 million Indians fall into the “middle-income” bracket. This group is educated, urbanizing rapidly, and eager to improve their quality of life.

However, this ambition often comes at a cost:

- Housing in major cities has become prohibitively expensive.

- Education and healthcare costs are rising faster than inflation.

- Social expectations around weddings, gadgets, cars, and travel are pressuring families to spend beyond their means.

The result? Many middle-class families are over-leveraged, meaning they’re spending more on repaying loans than they can comfortably afford.

EMIs Culture: Convenience or Trap?

The word “EMI” (Equated Monthly Installment) has become a part of everyday language in India. From mobile phones to refrigerators to overseas holidays, everything is available in bite-sized payments.

While EMIs offer access to a better lifestyle, they also:

- Encourage impulse buying

- Lead to cumulative debt from multiple sources (home loan, auto loan, personal loan, credit cards)

- Eat into monthly disposable income

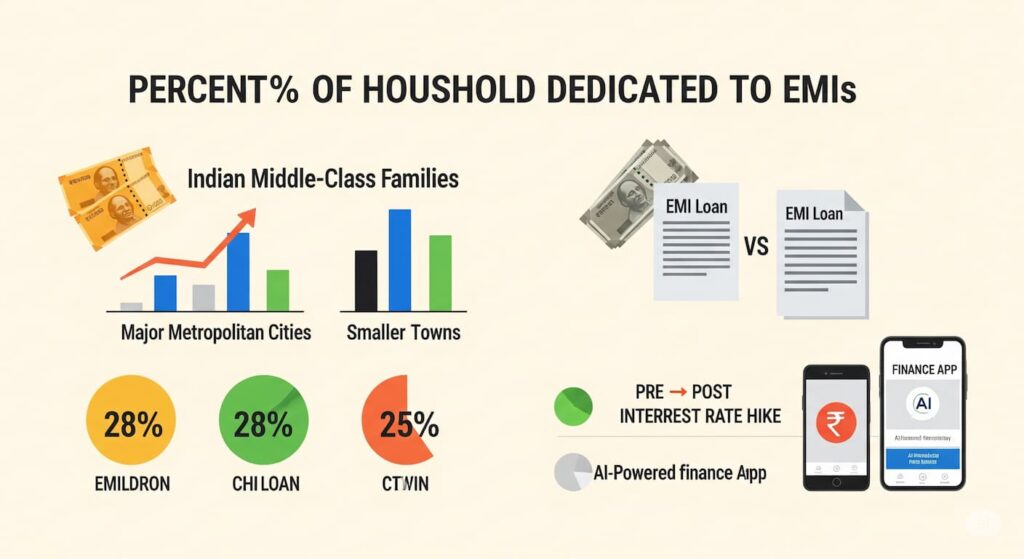

According to a 2023 CRIF High Mark report, more than 50% of salaried Indians spend over 30% of their income on EMIs. Financial advisors recommend this number stay under 20%.

So, what changed?

Factors Fueling the Debt Trap

Easy Access to Credit: Fintech apps and instant personal loan offers have made credit incredibly easy to obtain. Sometimes too easy.

Pandemic Impact: During COVID-19, many dipped into loans and credit cards to survive layoffs, medical emergencies, or loss of income.

Inflation and Lifestyle: While wages have grown modestly, inflation in essentials, school fees, and fuel has outpaced them. Meanwhile, the desire for a “better life” continues to grow.

Social Media Pressure: Constant exposure to influencer lifestyles and peer success stories on Instagram or LinkedIn can drive Fear of Missing Out and push people to spend more.

The Hidden Cost: Low Savings and High Stress

The biggest casualty of this debt culture is savings. Traditionally, Indian families were savers. But according to the RBI Household Financial Savings Report (2022), the savings rate has dropped to below 5% of disposable income, compared to over 10% a decade ago.

Consequences of low savings include:

- Inadequate emergency funds

- No buffer for medical or educational expenses

- Delayed retirement planning

- Higher mental stress and anxiety

How Financial Literacy Can Be a Game-Changer

One of the root problems is the lack of financial education. Most people don’t learn how to budget, save, or invest—not at home, not in school.

What can financial literacy teach?

- Budgeting: Understanding where your money goes

- Debt Management: Knowing good vs. bad debt

- Saving Discipline: Automating savings before spending

- Investment Planning: Making your money grow

Efforts like the RBI’s “Money Kumar” campaign and SEBI’s investor awareness programs are steps in the right direction. But more is needed—especially in regional languages and via platforms people actually use.

AI to the Rescue: Smart Tools for Smarter Decisions

Here’s where technology steps in. AI is not just for big banks or techies. It’s already making personal finance more accessible.

- AI-powered Budgeting Apps: Tools like Walnut, Money View, and ET Money use AI to track spending and categorize expenses automatically.

- Credit Score Insights: Platforms like CRED and OneScore help users monitor and improve their credit behavior.

- Chatbots for Queries: Banks are deploying AI chatbots that explain loan terms, EMIs, and payment schedules in simple language.

- Robo-Advisors: Platforms like Scripbox and Zerodha’s Coin use AI to suggest low-risk, diversified investment portfolios.

- Personalized Nudges: AI can analyze spending habits and send reminders or alerts when a user is about to overspend or miss a payment.

Real-World Impact: Stories from the Ground

Take the example of Priya, a teacher in Bengaluru, who used a financial planning app to identify that her spending on food delivery was more than her mutual fund SIP. She adjusted, saved more, and even started a PPF account.

Or Rajesh, an IT professional in Hyderabad, who consolidated his multiple loans into a single low-interest personal loan using an AI-driven aggregator platform, reducing his EMI burden by 25%.

These are small wins, but they add up.

What Can You Do? Practical Tips

- Track your spending: Use Excel, an app, or even a notebook—but do it.

- Prioritize high-interest debt: Credit card dues should be cleared before anything else.

- Build an emergency fund: Aim for 3-6 months of expenses.

- Automate savings: Treat saving like a monthly bill.

- Use credit smartly: Don’t borrow for non-essential expenses.

If your EMI load is over 30% of your income, consider debt restructuring or refinancing options.

Conclusion: Hope in a High-EMI World

India’s middle class is the backbone of its economy. Their aspirations are valid, and their struggles are real. But with a bit of guidance, smarter tools, and honest conversations about money, things can change.

AI can be a friend, not a foe. Financial literacy can be a superpower. Together, they can help India’s middle class move from stressed to secure.

What changes will you make today to ensure your money works for you, and not the other way around?

References:

- PRICE India Middle Class Report – https://www.price360.in/

- CRIF High Mark EMI Report 2023 – https://www.crifhighmark.com/

- RBI Household Savings Report – https://www.rbi.org.in

- SEBI Investor Awareness – https://investor.sebi.gov.in/

- McKinsey on Financial Inclusion – https://www.mckinsey.com/featured-insights