Introduction: Why AI is Transforming Supply Chain Financing Matters

Germany, known for its precision engineering and world-class manufacturing, depends heavily on strong and resilient supply chains. But financing these chains efficiently has always been a challenge, especially for small and medium enterprises (SMEs). Enter artificial intelligence (AI).

AI is transforming supply chain financing by bringing real-time visibility, faster decision-making, and predictive analytics into the mix. In Germany’s corporate banking sector, this shift is not just a tech trend—it’s a game-changer for how companies access working capital.

In this article, we’ll explore how AI is being used in supply chain finance across Germany, what it means for businesses and banks, and why you should care.

What is Supply Chain Financing, and Why Should You Care?

Before we dive into the tech, let’s quickly break down what supply chain financing (SCF) is.

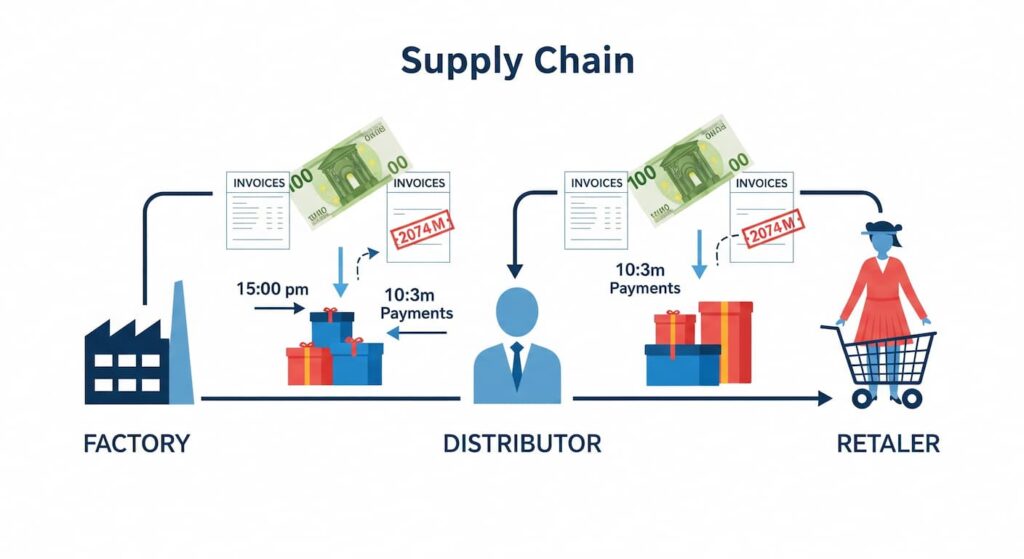

Supply chain financing refers to the tools and solutions that allow businesses to optimize cash flow by extending payment terms to suppliers while enabling suppliers to get paid early. It’s a win-win: buyers get more time to pay; suppliers get faster access to cash.

Common Methods in SCF:

- Reverse factoring: A bank or third-party pays the supplier on behalf of the buyer.

- Invoice discounting: Suppliers borrow money using unpaid invoices as collateral.

- Dynamic discounting: Buyers offer early payments in exchange for a discount.

Why It Matters in Germany

Germany is Europe’s industrial backbone. Think of companies like Siemens, BMW, and Bosch. Even smaller component suppliers play critical roles in massive production chains. Any delay in payments or financing can ripple through the entire economy.

But traditional SCF systems are often slow, paper-heavy, and prone to errors. That’s where AI steps in.

The Role of AI in Modern Supply Chain Financing

So, what exactly is AI doing in supply chain financing?

AI, or Artificial Intelligence, refers to machines or software that can mimic human intelligence. In the world of finance, it helps in analyzing big data, identifying patterns, and making predictions or decisions faster than any human could.

Key Ways AI is Transforming Supply Chain Financing

1. Risk Assessment and Credit Scoring

Traditionally, banks assess credit risk using old financial statements, often delayed by months. AI systems in Germany now use real-time data from supply chain activities, IoT sensors, shipping records, and transactional histories to assess creditworthiness instantly.

2. Invoice Fraud Detection

Germany’s corporate banking sector is especially vulnerable to invoice fraud. AI-powered tools scan for duplicate, altered, or suspicious invoices using anomaly detection. This is helping banks avoid costly mistakes.

3. Predictive Financing

AI models can predict when a supplier will need financing based on seasonal patterns, past data, and macroeconomic indicators. This allows banks to offer credit proactively, rather than reactively.

4. Dynamic Risk Pricing

Instead of fixed interest rates, some German banks are now using AI to calculate risk-based pricing for supply chain loans in real time.

Germany: A Fertile Ground for AI-Powered Financing

Germany is not just adopting AI—it’s actively shaping its future. The country has launched several initiatives to become a global leader in Industry 4.0, the digital revolution in manufacturing.

Local Examples

- Commerzbank partnered with Fraunhofer IML to develop AI-driven trade finance solutions.

- Deutsche Bank has invested in startups using AI for financial automation.

- SAP, headquartered in Walldorf, offers AI-enhanced supply chain and finance software used by corporates across the EU.

These institutions aren’t experimenting; they’re scaling real-world solutions.

Real-World Benefits for German Businesses

1. For SMEs

Small and medium-sized suppliers often suffer from long payment cycles. AI-driven SCF platforms are giving them faster access to funds with fewer documents required.

2. For Large Corporates

Big companies benefit from better visibility across their supply chain, reduced risk of default, and improved supplier relationships.

3. For Banks

German banks gain a competitive edge by offering faster, safer, and smarter financing products. They also reduce manual workloads.

Challenges and Concerns

While the benefits are clear, there are some challenges:

- Data Privacy: Germany has strict GDPR rules. AI systems must be compliant.

- Bias in Algorithms: If not trained properly, AI systems can unintentionally discriminate.

- Technology Adoption: SMEs may lack the resources to adopt new platforms.

That said, many of these hurdles are being addressed through partnerships, government funding, and training programs.

The Future Outlook

Experts believe that AI in supply chain finance is just getting started. According to McKinsey, AI could add up to $1 trillion in value annually across global banking, and Germany is poised to be a major beneficiary.

Emerging Trends

- Blockchain integration: For added transparency.

- AI-driven ESG scoring: Environmentally and socially responsible supply chains.

- Autonomous finance platforms: End-to-end automation of SCF.

Practical Takeaways

If you’re a business owner, banker, or policymaker in Germany, here are a few steps to stay ahead:

- Educate Yourself: Learn the basics of AI and SCF.

- Talk to Your Bank: Ask about AI-powered financing options.

- Audit Your Supply Chain: Make sure your data is clean and structured.

- Collaborate: Work with tech providers who understand the local market.

- Stay Compliant: Always align with GDPR and other regulations.

Final Thoughts

AI is transforming supply chain financing not just in buzzwords but in tangible, real-world outcomes. For Germany’s corporate banking scene, it marks a shift toward more transparent, inclusive, and resilient financial systems.

It’s a revolution that touches everyone—from a mid-sized factory in Bavaria to a fintech hub in Berlin.

So, the next time someone mentions AI and finance, remember: it’s not just robots taking over. It’s about helping people get paid faster, reducing risk, and building stronger economies.

References

-

- McKinsey & Company – “The Future of AI in Banking”:

https://www.mckinsey.com/industries/financial-services/our-insights/the-future-of-ai-in-banking - Deutsche Bundesbank – “Digital Transformation in German Banking”

https://www.bundesbank.de/en/tasks/topics/digitalisation-in-the-financial-sector-843646

- Commerzbank & Fraunhofer IML – Joint Press Release on AI in Supply Chain Finance

https://www.commerzbank.com/en/hauptnavigation/konzern/commerzbank_2/medien/medienmitteilungen/archiv1/2021_2/press_release_21_11_2021.html - SAP Official Website – AI Solutions for Supply Chain and Finance

https://www.sap.com/products/scm/supply-chain-finance.html - European Commission – General Data Protection Regulation (GDPR) Guidelines

https://ec.europa.eu/info/law/law-topic/data-protection/eu-data-protection-rules_en

- McKinsey & Company – “The Future of AI in Banking”: