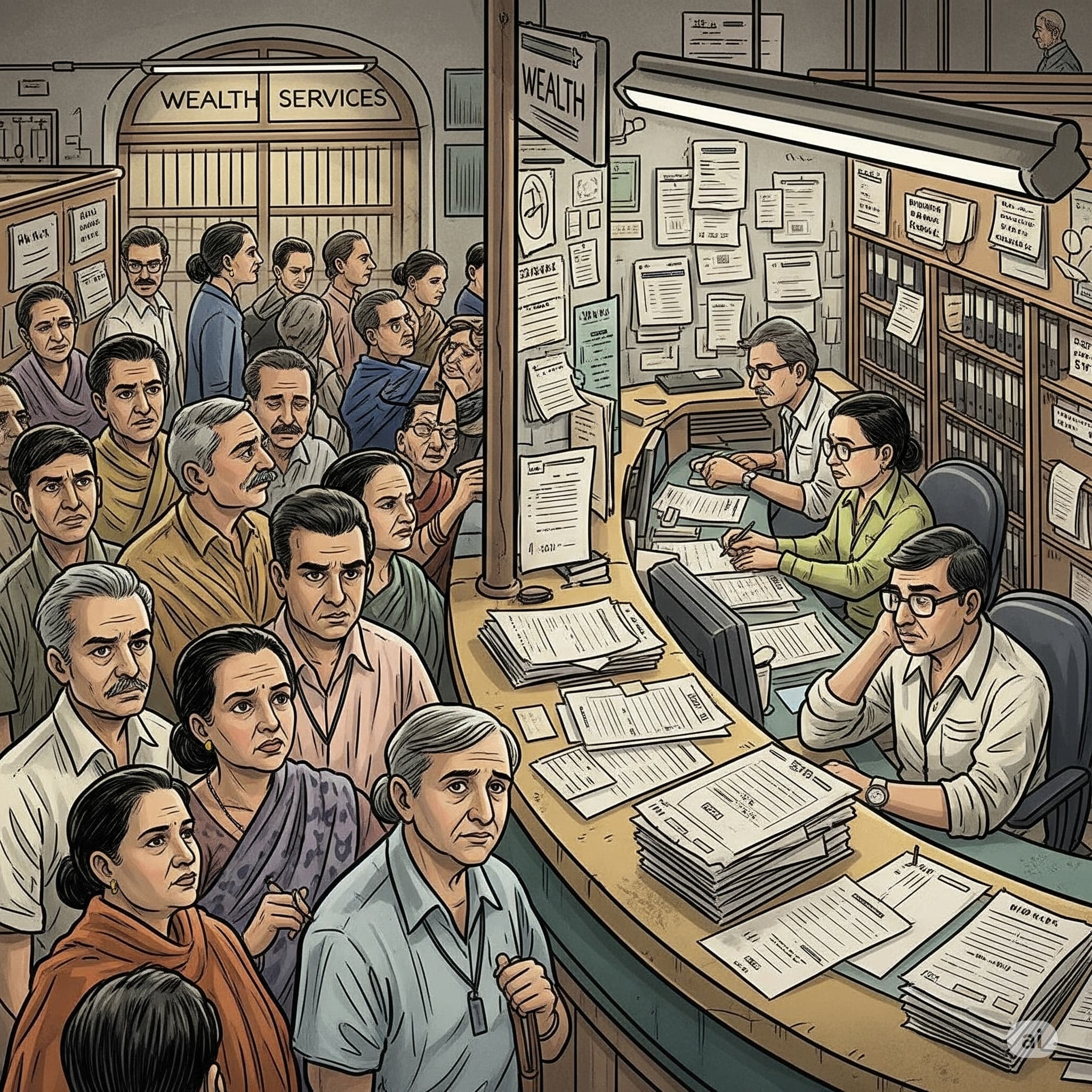

You walk into a bank in Mumbai, eager to invest your savings. The advisor hands you a generic brochure, recommends a one-size-fits-all mutual fund, and sends you on your way. A few years later, you realize your money barely grew—because the advice wasn’t tailored to your goals or risk appetite. This was the reality for millions of Indians just a decade ago. Wealth management — the art of helping people grow and protect their money—was once a luxury reserved for the ultra-rich. Traditional banks struggled to offer personalized, scalable solutions. But today, thanks to Artificial Intelligence (AI), that’s changing fast.

Indian banks—from SBI to HDFC to fintech startups like Groww—are now using AI to launch smarter, more accessible wealth management products. But how? What were the old problems? And what does this mean for everyday investors like you?

Let’s dive in.

The Old Problems: Why Wealth Management in India Was Broken

Before AI, wealth management in India faced four big challenges:

Limited Personalization (One-Size-Fits-All Advice)

- Most banks offered standardized investment plans—ignoring individual goals, incomes, and risk tolerance.

- Example:A 30-year-old entrepreneur and a 50-year-old government employee would get the same mutual fund suggestion.

- Statistic:A 2020 SEBI report found that only 12% of Indian investors received personalized financial advice.

High Costs (Wealth Management Was Only for the Rich)

- Human financial advisors were expensive, charging 1-2% of assets under management (AUM).

- Middle-class investors (earning ₹5-10 lakh/year) couldn’t afford these services.

Lack of Trust & Transparency

- Many investors feared mis-selling—where banks pushed high-commission products (like ULIPs) instead of the best options.

- Fact:In 2018, RBI fined several banks for mis-selling wealth management products (Economic Times).

Slow, Manual Processes

- Portfolio reviews took weeks.

- Customers had to visit branches repeatedly for updates.

How AI is Fixing These Problems

AI is transforming wealth management in India by making it smarter, cheaper, and fairer. Here’s how:

Hyper-Personalized Recommendations (Robo-Advisors)

- AI analyzes income, spending habits, goals (buying a house, retirement, etc.), and even social media behavior(with consent) to suggest tailored portfolios.

- Example:ICICI’s iWealth and Axis Bank’s Axis Direct use AI to customize investment plans.

- Statistic:A 2023 BCG report found AI-driven advice increased investor returns by 15-20% compared to generic plans.

Lower Costs (Democratizing Wealth Management)

- AI-powered robo-advisors charge as little as 0.1-0.5% fees, making professional advice affordable.

- Example:Groww and Kuvera offer free AI-driven tools for small investors.

Fraud Detection & Risk Management

- AI scans market trends, news, and global events to predict risks(like stock crashes).

- Example:HDFC’s AI system alerts customers before a high-risk stock dips.

Instant, 24/7 Customer Support (Chatbots & Virtual Assistants)

- No more waiting for bank hours! AI chatbots (like SBI’s SIA) answer queries in seconds.

Automated Portfolio Rebalancing

- AI continuously adjustsinvestments based on market shifts—no human delays.

- Statistic:Banks using AI rebalancing saw 30% fewer losses during the 2022 market crash (McKinsey).

Real-Life Examples: AI-Powered Wealth Management in India

Case Study 1: HDFC’s “SmartBuy” Investment Assistant

- Uses AI to recommend stocks, mutual funds, and bondsbased on real-time data.

- Result: 40% more customersstarted investing within 6 months of launch (HDFC Annual Report 2023).

Case Study 2: Zerodha’s “Coin” (AI for Direct Mutual Funds)

- AI compares 5,000+ fundsto pick the best for each user.

- Impact:Reduced investor fees by 80% (Zerodha Blog, 2024).

Case Study 3: Kotak’s AI Tax Optimizer

- Suggests tax-saving investments (ELSS, NPS)based on salary data.

- Helped users save ₹50,000+ per yearon average (Kotak Wealth Report 2023).

Challenges & Risks of AI in Wealth Management

AI isn’t perfect. Key challenges include:

Data Privacy Concerns

- If AI accesses your bank statements/spending history, who keeps it safe?

- Solution:RBI’s strict data localization rules (2023) require banks to store AI data in India.

Over-Reliance on AI (Losing the Human Touch)

- Some investors still prefer face-to-faceadvice for big decisions.

- Statistic:35% of Indians don’t trust fully automated wealth tools (EY Survey 2024).

Algorithm Bias

- If AI is trained mostly on urban, high-income data, it might ignore rural investors.

- Example:A farmer may need different advice than a tech employee.

What This Means for You

If You’re an Investor:

- Try AI-powered tools(Groww, Kuvera, or your bank’s robo-advisor).

- Start small—even ₹500/month can grow with smart AI advice.

If You Work in Finance:

- Learn AI basics(Coursera, NSE courses).

- Focus on hybrid roles(AI + human advisory).

If You’re a Bank or Fintech Startup:

- Partner with AI firms(Tata AI, Infosys Nia) to build better products.

- Educate customers—many still don’t understand AI-driven investing.

Final Thoughts: A Smarter, Fairer Future for Wealth in India

AI isn’t replacing financial advisors—it’s making them better. Now, even a college student with ₹1,000 can access wealth management tools that were once only for millionaires.

But here’s a question: Would you let AI manage your money, or do you still want a human in the loop? Let’s discuss in the comments!

References: