In a world where billions of dollars cross borders daily, the risk of fraud in international trade transactions is a growing concern. That’s where new technologies come in. The United States is increasingly turning to AI to combat fraud in international trade, helping protect businesses, banks, and even everyday consumers from financial losses and security threats.

But how exactly does this work? And why should you care?

Let’s break it all down in a simple and friendly way.

What Is International Trade Fraud and Why Should You Care?

Before diving into the technology, let’s understand the problem.

International trade fraud refers to illegal activities that happen during import/export processes. Common forms include:

- Fake invoices

- Over- or under-invoicing

- Phantom shipments (shipping goods that don’t exist)

- Identity theft

- Shell companies

Why does it matter?

- Costs global businesses over $1 trillion annually, according to PwC.

- Makes products more expensive for consumers.

- Can destabilize economies, especially in developing countries.

- Increases compliance and regulatory pressure on companies.

In the USA, with its huge volume of imports and exports, fighting this kind of fraud is critical for economic security.

Why Traditional Methods Are No Longer Enough

For decades, trade fraud was tackled using manual audits, paperwork verification, and customs inspections. But the volume of global trade has exploded. The U.S. alone handles $5 trillion in trade every year.

Traditional methods struggle with:

- Processing massive volumes of documentation

- Detecting subtle or well-disguised fraud

- Responding in real time

That’s where AI steps in.

Understanding the Core Technology: AI to Combat Fraud in International Trade

AI (Artificial Intelligence) uses algorithms and data to recognize patterns and make decisions, much like a human would—but faster and without fatigue.

Here’s how AI helps fight trade fraud:

- Document Scanning and Verification

AI can scan thousands of documents (like invoices, bills of lading, and certificates) instantly and flag inconsistencies, such as:

- Mismatched values

- Duplicate entries

- Fake suppliers or buyers

- Pattern Recognition

By learning from past fraud cases, AI can recognize patterns or red flags that humans might miss, such as:

- Transactions that fall just below reporting thresholds

- Sudden changes in supplier behavior

- Repeated dealings with high-risk regions

- Real-Time Risk Scoring

Each transaction is assigned a fraud risk score. High-risk transactions are flagged for further investigation before any money or goods change hands.

- Identity Verification

AI tools verify the identities of buyers, sellers, and intermediaries using biometrics, social graphs, and historical records.

- Integration with Blockchain

AI systems can work with blockchain technology to ensure that trade data is tamper-proof and transparent across the supply chain.

U.S. Government and Private Sector Efforts

The United States is investing heavily in AI-driven fraud detection. Some notable efforts include:

U.S. Customs and Border Protection (CBP)

- Using AI to inspect shipments and documents in real time.

- Partnering with tech firms to improve data security and automation.

The Financial Crimes Enforcement Network (FinCEN)

- Employing AI to spot money laundering and trade-based financial crimes.

Private Sector Innovations

Many large U.S. banks, logistics companies, and fintechs are developing in-house AI solutions. Examples include:

- IBM Watson: Analyses trade documents and detects fraud patterns.

- Maersk & TradeLens: A blockchain platform using AI to streamline and secure supply chains.

Real-World Impact: What It Means for You

Even if you’re not directly involved in international trade, AI’s role in fraud prevention affects you:

- Safer imports: You can trust that the imported goods you buy are genuine and legally traded.

- Lower costs: Reduced fraud means lower losses, which helps keep prices stable.

- Job protection: Preventing trade fraud protects legitimate businesses and workers from being undercut.

For business owners, it also means:

- Faster approvals for shipments

- Lower risk of compliance penalties

- Better relationships with partners and regulators

Challenges and Ethical Questions

As promising as AI is, there are challenges:

- Data Privacy: Sensitive company data must be protected.

- Bias and Accuracy: Poorly trained AI could flag honest businesses as suspicious.

- Job Displacement: Manual verification roles may shrink, affecting employment in customs and compliance.

However, with proper oversight and ethical frameworks, these challenges can be managed.

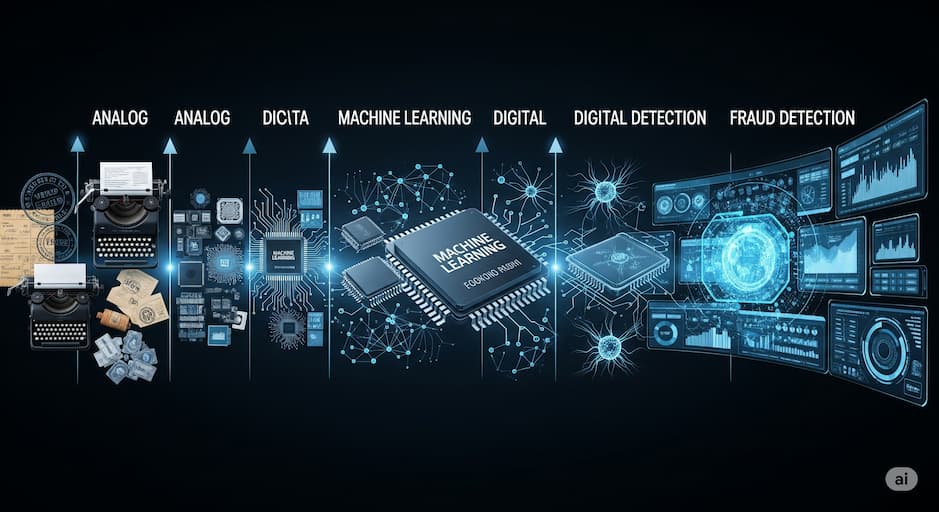

Historical Context: From Manual Logs to Machine Learning

Back in the day, trade fraud was spotted with paper logs and rubber stamps. Everything was slow, manual, and error-prone.

Then came:

- Digitization in the 1990s: Excel sheets replaced ledgers.

- Automation in the 2000s: Software handled document filing.

- AI and Blockchain (2010s onward): These now bring predictive insights, real-time decisions, and secured data flow.

The Global Context: Other Countries Doing the Same

The U.S. is not alone. Many countries are adopting AI in trade fraud prevention:

- Singapore: Leading in blockchain-based trade systems.

- Germany: Using AI for customs risk scoring.

- UAE: Integrating AI with smart ports and logistics systems.

Collaboration among these nations helps standardize practices and share threat intelligence.

What Should Be Done Next?

Governments, businesses, and individuals can take steps to ensure AI is used wisely:

Governments

- Encourage international cooperation

- Invest in AI training and transparency

- Set ethical standards

Businesses

- Adopt AI tools that are secure and explainable

- Train staff to work alongside AI

- Share fraud cases and data anonymously to improve detection

Individuals

- Stay informed about trade security

- Support policies that promote digital transparency

Final Thoughts: The Future of Trade is Smart and Safe

International trade is the backbone of modern life. From your smartphone to your morning coffee, trade connects us all. But with it comes risk. Thankfully, the USA’s use of AI to combat fraud in international trade is making a real difference.

By embracing smart, ethical technology, we can create a world where trade is faster, safer, and more fair—not just for big companies but for everyone.

So next time you buy something made overseas, remember: AI might have helped make sure it was a fair deal.

Sources:

- U.S. Customs and Border Protection Annual Report: https://www.cbp.gov/about/reports-publications

- PwC Global Economic Crime and Fraud Survey: https://www.pwc.com/gx/en/services/forensics/economic-crime-survey.html

- IBM Watson & TradeLens Whitepaper: https://www.ibm.com/supply-chain/tradelens https://www.ibm.com/blogs/blockchain/

- World Trade Organization Reports on Digital Trade Security: https://www.wto.org/english/res_e/publications_e/publications_e.htm