Imagine you want to buy a car, but you follow Islamic principles that forbid paying or receiving interest (riba). Traditional auto loans with interest are off the table, but you still need a practical way to finance your new vehicle. How can this be done? The answer lies in the innovative world of Islamic auto financing — a method designed to help Muslims and ethical investors alike buy cars without involving interest, while still ensuring fairness and transparency.

In this article, we’ll explore how Islamic banks structure auto financing without interest. We’ll explain key concepts, share how these financing models work in real life, highlight why they matter, and offer practical insights for buyers and businesses. Whether you’re a curious car buyer, a finance professional, or just someone interested in ethical banking, this friendly guide will give you a clear understanding of this important financial service.

The Basics: What is Auto Financing?

Before diving into the Islamic side of things, let’s quickly understand what auto financing means. Simply put, auto financing is a way to buy a car by paying in installments over time rather than paying the full price upfront.

In conventional finance, this usually means taking out a loan with interest — the bank lends you money, and you repay the principal plus an extra charge called interest. But for Muslims and those avoiding interest for ethical reasons, this traditional route isn’t acceptable.

Why Islamic Auto Financing is Different: No Interest, No Problem

In Islamic banking, charging or paying interest (riba) is prohibited because it is seen as unjust enrichment. Instead, Islamic banks use Shariah-compliant contracts that structure auto financing in a way that avoids interest but still allows for profit.

Key Principles Behind Islamic Auto Financing:

- No interest (riba): Returns must come from legitimate trade or leasing activities, not from interest charges.

- Risk-sharing: Both the bank and the customer share the risks and rewards.

- Transparency: Clear terms and fair dealings are essential.

- Asset-backed financing: The bank finances real assets, not just money lending.

How Islamic Banks Structure Auto Financing

Several popular Shariah-compliant contracts are used in Islamic auto financing. Let’s break down the most common ones:

- Murabaha (Cost-Plus Financing)

Murabaha is the most common method used by Islamic banks to finance cars. Here’s how it works:

- The bank buys the car from the dealer.

- The bank then sells the car to the customer at a marked-up price.

- The customer pays the bank back in fixed installments over an agreed period.

The markup is essentially the bank’s profit, but is agreed upon upfront, so there is no hidden interest or uncertainty.

Example:

If the car costs $20,000, the bank might sell it to you for $22,000, payable in monthly installments over 3 years. The $2,000 is the profit margin, not interest, and you know this amount from the start.

- Ijara (Leasing)

Ijara is a leasing contract where the bank buys the car and leases it to you:

- You pay monthly lease rentals.

- At the end of the lease period, you may have the option to buy the car at a pre-agreed price.

- The bank retains ownership during the lease, so the lease payments are essentially rental fees.

This method resembles traditional car leasing but is structured to meet Islamic principles.

- Diminishing Musharakah (Partnership Model)

Diminishing Musharakah means a shared ownership model:

- You and the bank buy the car together.

- Over time, you gradually buy the bank’s share through installment payments.

- Eventually, you become the full owner.

This approach encourages partnership and risk-sharing between the bank and the customer.

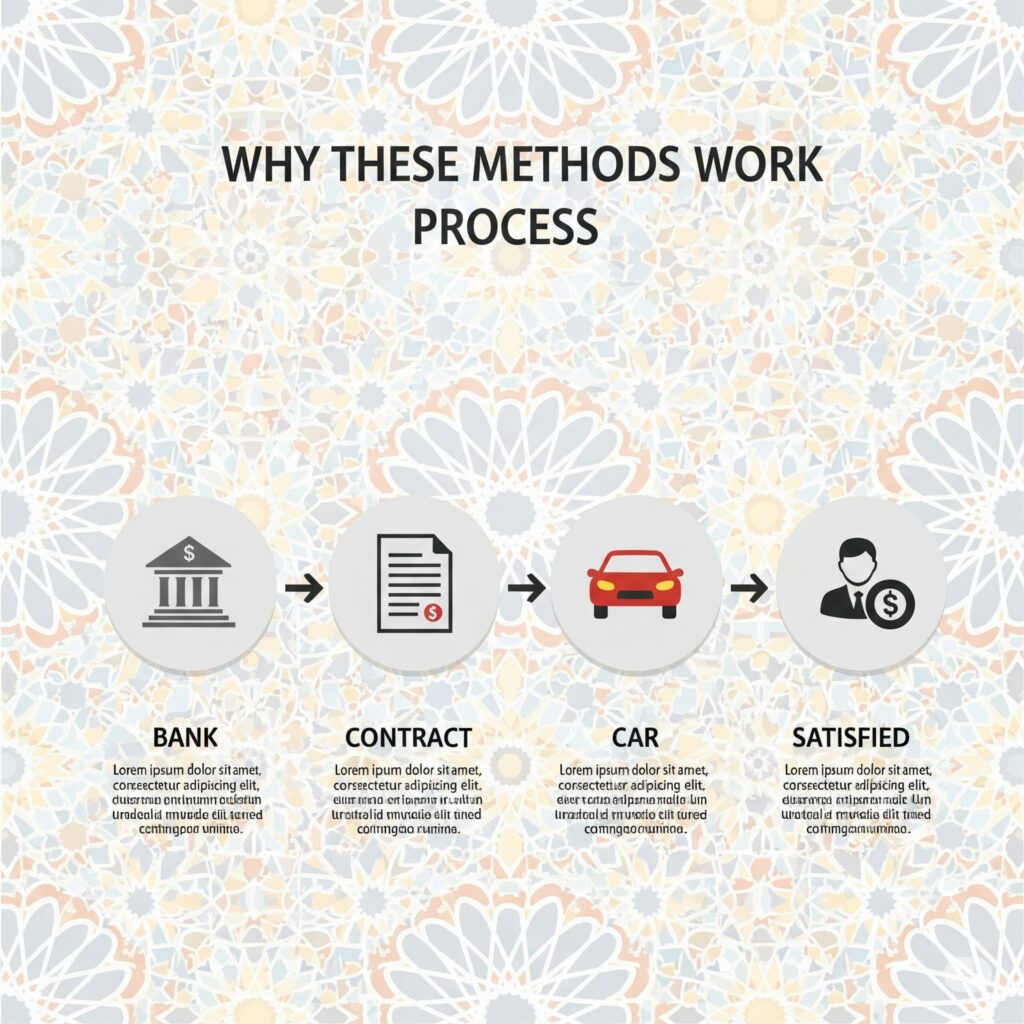

Why These Methods Work: The Logic Behind Islamic Auto Financing

These contracts replace interest with trade, leasing, or partnership profit mechanisms. They:

- Ensure compliance with Islamic ethics.

- Provide clear, upfront pricing.

- Avoid excessive uncertainty (gharar).

- Involve tangible assets, not just money lending.

Real-World Impact: Why Islamic Auto Financing Matters

Islamic auto financing is growing globally, with markets in the Middle East, Southeast Asia (especially Malaysia), and parts of Europe and North America expanding their offerings.

- According to a report by Deloitte (2023), the Islamic finance market reached over $3 trillion worldwide, with auto financing being a growing segment.

- In Malaysia, Islamic auto financing accounts for approximately 20-30% of total vehicle financing (Source: Bank Negara Malaysia).

- The demand reflects not just Muslim consumers but also ethical investors seeking alternatives to conventional finance.

Challenges and How Islamic Banks Are Addressing Them

While Islamic auto financing is effective, some challenges exist:

- Higher upfront costs: Markups in Murabaha might be higher than conventional loan interest.

- Limited awareness: Some customers are unfamiliar with how Islamic auto financing works.

- Complex documentation: Legal contracts can be complex.

To improve, banks are:

- Educating customers with clear, transparent materials.

- Using technology for faster approvals and easier processes.

- Developing competitive pricing models.

Practical Tips for Consumers Interested in Islamic Auto Financing

- Understand the contract: Ask your bank to explain the terms clearly.

- Compare offers: Check different banks for the best markup or leasing terms.

- Verify Shariah compliance: Look for certification from recognized Shariah boards.

- Plan your budget: Fixed installments help in planning monthly expenses.

- Consider the total cost: Remember that markup and fees combined form your total payment.

The Bigger Picture: Islamic Auto Financing and Ethical Finance

Islamic auto financing is part of a broader movement toward ethical and responsible finance. It highlights how finance can respect cultural and religious values while supporting economic activity.

Whether you’re Muslim or just seeking fair finance options, the principles of transparency, risk-sharing, and asset-backed funding offer a refreshing alternative to conventional loans.

Conclusion: How Will Islamic Auto Financing Evolve?

Islamic auto financing has come a long way, offering millions access to cars without compromising their faith or ethical beliefs. As awareness grows and technology advances, we can expect more innovation and better customer experiences.

What do you think about the idea of buying a car without paying interest? Would you consider Islamic auto financing as an option? Share your thoughts!

References

- Deloitte. (2023). Global Islamic Finance Market Report. https://www2.deloitte.com

- Bank Negara Malaysia. (2024). Annual Report on Islamic Banking. https://www.bnm.gov.my

- International Islamic Financial Market (IIFM). https://www.iifm.net/

- Reuters. (2023). Trends in Islamic Auto Financing.